O fim de ano está chegando rapidamente e os varejistas já se preparam para isso com novos catálogos, promoções sazonais, site atualizado, novos conteúdos e muito mais. Mas como evitar o temido “carrinho abandonado”, que ameaça destruir todo o nosso trabalho árduo, fazendo com que prospects e clientes saiam no meio da jornada de compra?

O RichRelevance Dynamic eXperiences com o Engage pode te ajudar nessa tarefa.

Pré-Checkout

Enquanto a maioria das soluções de carrinho abandonado são acionadas após o fato ocorrido, você tem algumas ferramentas incríveis à sua disposição antes de perder o cliente em seu funil.

1. Adicionar ao Carrinho Pop-up para Upsells

Quando um cliente adiciona um item ao carrinho, este é um momento perfeito para engajar e incentivar um upsell. A Richrelevance sabe qual item o cliente escolheu e também sabe quais upsells combinam com este item. Os principais benefícios incluem aumento do valor médio do pedido e mais engajamento.

Com uma vasta biblioteca de estratégias para upsells o RichRelevance Xen AI facilita a criação da lógica certa para o negócio que leva em consideração o contexto do usuário, aprende com o comportamento dele e usa o machine learning para garantir a relevância.

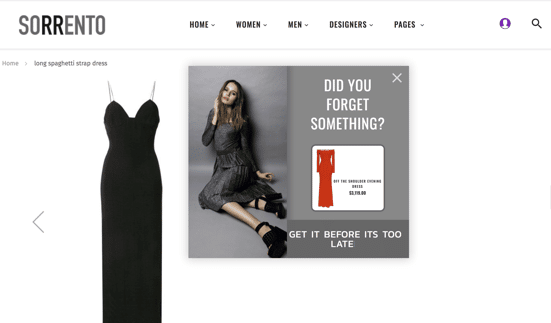

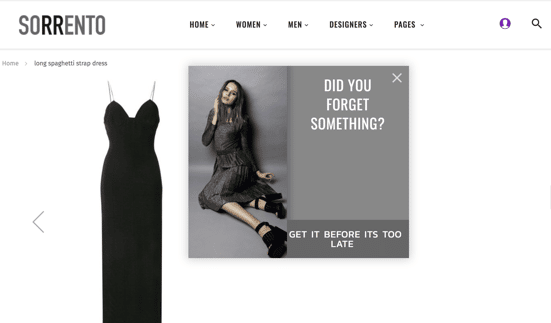

2. Pop-ups para intenção de abandono e baseados em tempo

Quando um cliente move o mouse para a barra de endereços ou para fechar o navegador da web, isso sinaliza “intenção de saída”.

Usando o Engage Dynamic eXperiences, um pop-up pode ser exibido ao cliente antes que ele realmente saia do site. Isso pode ser usado para mostrar mensagens específicas para ajudá-lo a reconsiderar – por exemplo, um cliente com um item em seu carrinho pode receber uma mensagem “Não esqueça de finalizar o pedido” ou “Esqueceu algo”. Além disso, esta é também uma oportunidade para mostrar ofertas / promoções (por exemplo, “ganhe 10% de desconto”) que motivam ainda mais os clientes a não abandonarem.

E ainda, você pode usar disparos acionados por tempo que funcionam quando um cliente engajado ficou por mais de X minutos em seu site.

A RichRelevance tem vários modelos prontos para uso que facilitam muito a implementação. Casos de uso adicionais também podem ser estendidos e personalizados facilmente.

Outros casos de uso incluem:

- Nova aquisição: ajuda os usuários que não estão familiarizados com seu site com um pop-up que tenha uma caixa de pesquisa ou as últimas chegadas, por exemplo.

- Cadastro de e-mail: com o custo de aquisição aumentando constantemente, é uma ótima maneira de capturar novos e-mails para sua lista de mailing.

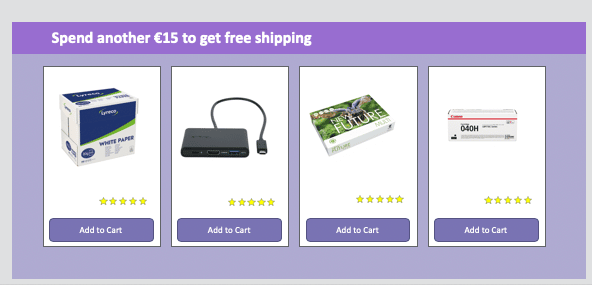

3. Promoções de estímulo ao aumento do carrinho

Direto ao ponto: A Amazon nos mal acostumou com o frete grátis… como consumidores, este é um grande ponto de atrito, e como os varejistas é uma ameaça competitiva muito importante. Ignore esse fato e veja as vendas se evaporarem.

Mas isso tem que ser oferecido para todos os produtos? Especialmente se você tiver itens de baixo valor agregado, para os quais a conta não fecha. Como você pode garantir que os incentivos estejam alinhados entre sua empresa e seus clientes? Usando estímulos no carrinho.

Esse recurso interessante permite que você controle o limite após o qual um cliente pode ver incentivos, como frete grátis, amostras grátis ou brindes.

O mecanismo RichRelevance Xen AI pode calibrar e aprender o comportamento do usuário para mostrar os produtos certos após examinar o valor do carrinho. A diferença entre o valor do carrinho (atual) e os limites promocionais é calculada e são exibidas as recomendações mais assertivas de produto e conteúdo.

Pós-Checkout

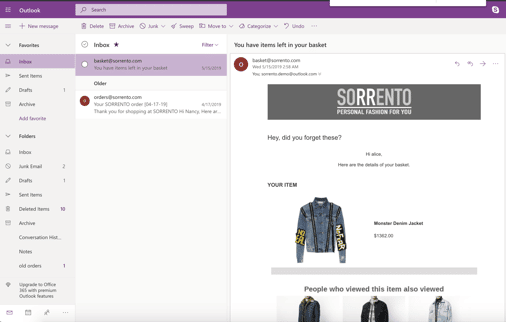

4. E-mail de carrinho abandonado – com personalização

Este é o caso de uso mais comum, mas geralmente implementado sem personalização. Quando um cliente adiciona um item ao carrinho ou à cesta e deixa o site, um e-mail é enviado pouco depois para trazê-lo de volta ao site para concluir a compra.

O segredo aqui é que o e-mail precisa estar ciente de que o cliente concluiu a compra em outros canais para que não seja apenas um instantâneo “idiota” do conteúdo do carrinho existente, ainda mais quando um desconto é oferecido.

Com a personalização RichRelevance, que funciona durante o horário “de abertura” versus o horário de envio, os clientes sempre recebem as melhores e mais recentes ofertas e promoções. Por exemplo, se eles abandonaram o carrinho enquanto compravam blusas, o e-mail de carrinho abandonado personalizado detecta que eles concluíram a compra e mostraram dinamicamente sapatos ou cintos – um produto complementar – em seu lugar.

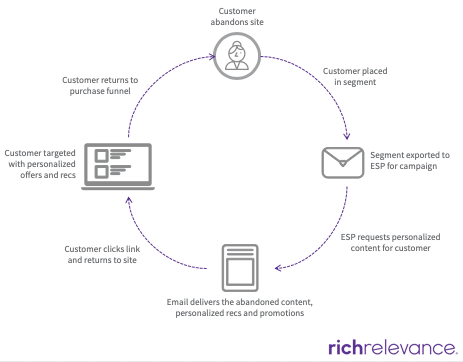

5. Personalize o ciclo de vida Email

Adicionalmente, sendo agnóstica em relação a sua ferramenta de disparo, a RichRelevance pode trabalhar com qualquer ESP e temos visto bons resultados com o Oracle Responsys e principalmente quando o cliente usa a funcionalidade de exportação de segmento dentro da RichRelevance Personalization Suite. Dessa forma, você usa a sua ferramenta favorita de e-mail para entrega – que, combinada com RichRelevance, permite a criação de uma solução completa de reengajamento.

A RichRelevance informará o seu ESP sobre quem reengajar, alimentar o conteúdo da mensagem e definir a próxima visita ao site com base na campanha ativa.